When Should You Take CPP?

Purpose Investments

.28 Oct 2022

.The Canada Pension Plan (CPP) is one of the two main pillars of Canada’s public retirement income system (along with Old Age Security), providing a lifelong source of inflation-adjusted income. But while these government benefits are great, many don’t realize the timing of when they decide to begin taking the CPP benefit can significantly change the amount received.

Deciding when to take CPP is not a one-size-fits-all situation, and there are many factors to consider with your financial planner. For example, you can turn on your CPP benefit tap the month following your 60th birthday, but you can also delay it until your 70th.

But what happens in either situation? Let’s take a look.

2022 Maximum CPP Amounts

(For illustrative purposes only)

(For illustrative purposes only)

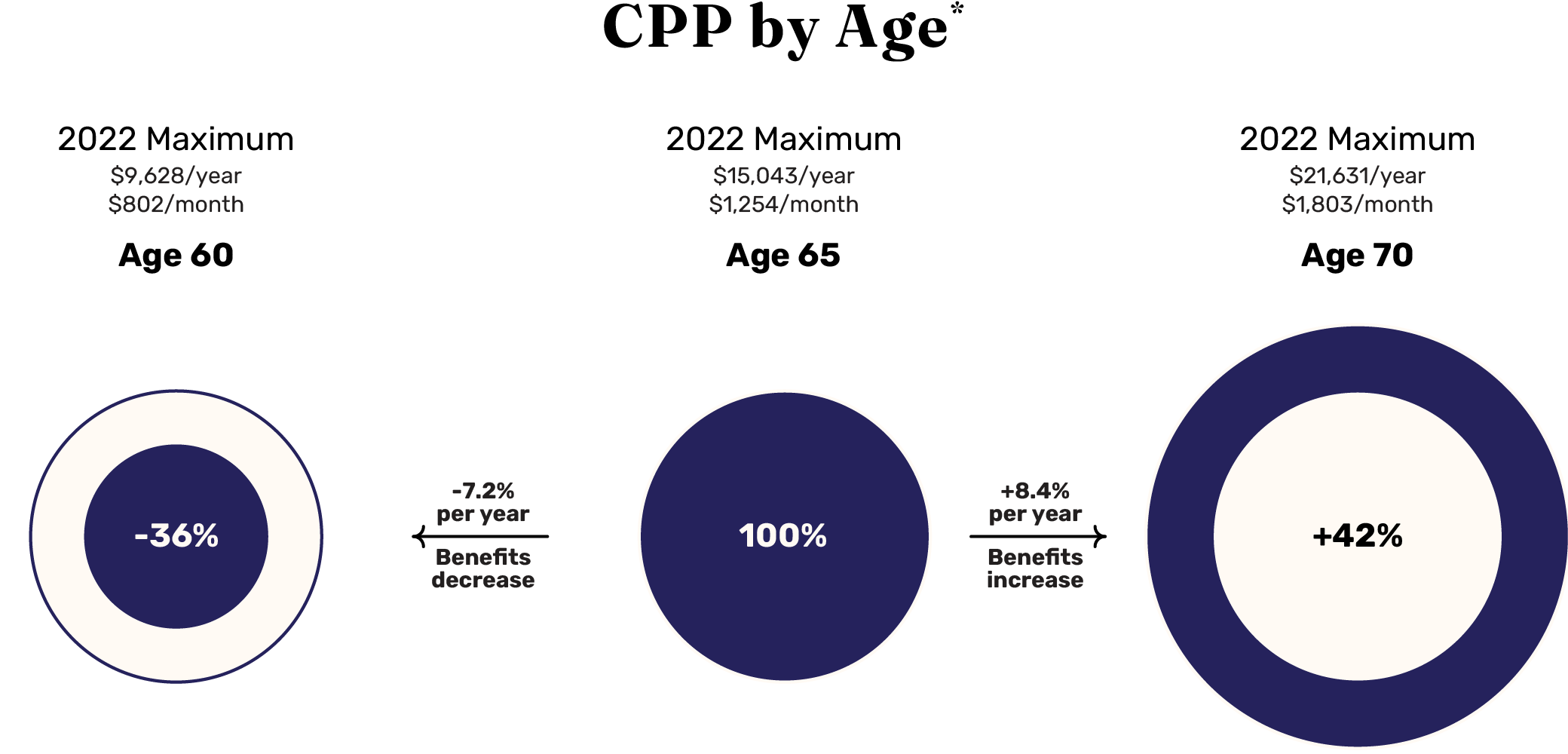

As mentioned earlier, you can turn on your CPP tap and receive your benefit the month after you turn 60. But doing so, however, decreases the amount you receive. For each month before your 65th birthday, your total amount reduces by 0.6%. So, if you begin receiving your CPP at 60, your total amount is reduced by 36%.

Conversely, the amount you receive increases by 0.7% each month after your 65th birthday. This monthly increase adds up to an extra 42% when you turn 70 – please note that while you can continue to delay after 70, there are no increases in the amount you receive from CPP, so there is no benefit in doing so.

How much you receive each month depends on a few factors like the total number of years you worked and your salary, which dictated your CPP contribution – according to the Government of Canada, the average amount for a newly retired person in July 2022 is $727.61.

(For illustrative purposes only)

(For illustrative purposes only)

It may seem like the obvious choice would be to delay CPP until 70, but it’s not so black and white. What’s best for you may not be the best for someone else. While what’s best for you should be discussed with your financial planner, let’s look at why one might choose 60, 65, or 70.

CPP at 60

CPP is adjusted for inflation, but your payments are permanently reduced by 36%. If you live into your nineties (a genuine possibility), that’s 30+ years of lower amounts – there’s no denying that it significantly lowers your total amount collected. Sure, it’s a longer period of receiving payments, but at a much lower rate.

You may think, “I’ve been contributing to this almost my entire life. I just want to get something out of it as soon as possible.” And that feeling is entirely understandable. It’s also where your financial planner should come in, breaking down the fundamentals in your retirement plan and cash flow in retirement to see if it makes sense to take it now.

The first and most glaring reason someone would opt to begin their CPP benefit at 60 is if they need the money now. Immediate financial needs outweigh future losses. Maybe they were laid off later in their career or had to take early retirement because of poor physical health.

Another reason to consider taking CPP at 60 is if you have a lower life expectancy. Perhaps you’re battling an illness, or maybe you have a parent or sibling who passed away early. For whatever reason, if your life expectancy is significantly lower than most other Canadians, it could make sense to turn the CPP payment tap on early.

CPP at 65

65 is the “default” age for many things related to retirement, but there needs to be more planning than simply taking your CPP benefit because that’s the age everyone else does it.

But there are valid reasons why you would want to start collecting at 65. Maybe you just retired and need to replace the lost income stream or want to preserve as much of your Registered Retirement Savings Plan (RRSP) and other savings as possible to leave to your children.

Many people spend and travel more early in retirement as opposed to climbing Kilimanjaro at 88 (which is not out of the question, mind you as your life expectancy might be higher than you think). The extra income stream can potentially help you cross off items on your bucket list earlier in retirement. Just be aware that you are foregoing the opportunity for higher levels of your CPP benefit and that it aligns with your retirement plan.

CPP at 70

While everyone’s situation is different, oftentimes, it makes financial sense to delay your CPP benefit until age 70. As mentioned earlier, every month you wait past 65, your amount received increases by 0.7% to a total of 42% when you turn 70, in addition to inflation adjustments.

Dr. Bonnie-Jeanne MacDonald, Director of Financial Security Research at Toronto Metropolitan University’s National Institute on Ageing and member of the Longevity Advisory Committee, believes “delaying [CPP] benefits for as long as possible is the safest and most inexpensive approach to get more secure, worry-free pension income that lasts for life and keeps up with inflation.”

It may seem counterintuitive to delay CPP and draw down the rest of your assets – stressful even. But Canadians are also living much longer lives, creating the risk of outliving one’s savings. Spending down your RRSP in your 60s while deferring CPP is like converting your risk assets into guaranteed lifetime income that will increase as time goes on.

The Bottom Line

There is no one-size-fits-all answer for when to begin taking your Canada Pension Plan benefit. What’s best for your particular situation may not be the same for someone else. It’s a conversation you should have with your financial planner because having the right data will help inform your decision. But you will always receive more if you wait, even if you retire early.

If your biggest fear in retirement is outliving your money, then why not look to design your retirement income streams to protect against this very real risk? The Longevity Pension Fund is another tool to provide additional lifetime income with an attractive starting rate that’s designed to increase over time.** Its exposure to real assets, like energy, real estate, and infrastructure, helps protect portfolios against inflation.

Speak with your advisor to see how Longevity can fit into your portfolio, or contact us if you’d like to chat with our retirement income specialist.

* “Canada Pension Plan Retirement Pay Dates for 2022: How Much CPP Will I Get?” Wealthsimple: https://www.wealthsimple.com/en-ca/learn/how-much-cpp-retirement

** The Longevity Pension Fund is designed to provide income for life, with an initial targeted annual income payment of 6.15% for a 65-year-old individual. The payments are designed to increase over the long term; however, they may go up or down to reflect the performance of the underlying investments and other factors such as mortality experience of the cohort. A traditional lifetime income solution could include a lifetime income annuity with a 10-year guarantee period, which has on average a fixed starting payment of 5.76% for 65-year-old males (Source: Cannex, May 19, 2021).

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. The prospectus contains important detailed information about the investment fund. Please read the prospectus before investing. There is no assurance that any fund will achieve its investment objective, and its net asset value, yield, and investment return will fluctuate from time to time with market conditions. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Income in the form of Fund distributions is not guaranteed, and the frequency and amount of distributions may increase or decrease.The Fund has a unique mutual fund structure. Most mutual funds redeem at their associated Net Asset Value (NAV). In contrast, redemptions in the decumulation class of the Fund (whether voluntary or at death) will occur at the lesser of NAV or original purchase price less distributions paid.

This information is provided for illustrative and discussion purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. Historical trends do not imply, forecast or guarantee future results. Information is as of the date indicated and subject to change without notice. Nothing herein constitutes a prediction or projection of future events or future market behaviour.

The Longevity Pension Fund is managed by Purpose Investments Inc. The document is not investment advice, nor is it tailored to the needs or circumstances of any investor. Talk to your investment advisor to determine if the Longevity Pension Fund is right for you and always read the prospectus before investing. Nothing on this document shall be considered a solicitation to buy or an offer to sell, or a recommendation for, a security, or any other product or service, to any person in any jurisdiction where such solicitation, offer, recommendation, purchase, or sale would be unlawful under the laws of that jurisdiction. No securities commission or similar regulatory authority has reviewed this document and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments believe to be reasonable assumptions, Purpose Investments cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.