A New Alternative to Annuities

Fred Vettese

.6 Jul 2021

.6 Min Read

Nobody wants to run out of money, especially after they’ve retired. For middle-income Canadians with a 6-figure (or even 7-figure) nest egg, I have long recommended earmarking a quarter to a third of it to buy a life annuity upon retirement. This protects them from outright poverty if they end up living longer than average or if their market-based investments do especially poorly. In spite of these advantages, annuities have few takers, a conundrum that is known among academics as ‘the annuity puzzle’.

Rather than trying to solve that puzzle, it may be better to change the paradigm. Purpose Investments has recently launched the Longevity Pension Fund (LPF), a product that provides income protection similar to annuities but without the same restrictions that make annuities so unattractive. The table summarizes the main features of both annuities and the LPF.

Longevity Pension Fund versus an Annuity

A case study will help to reveal why the LPF may prove to be more popular than annuities. Consider the following example involving Nick and Sally.

*Amount before considering an annuity

We will start by assuming that future investment returns are abysmal since this is when annuities shine. Let’s say that returns track the 5th percentile of all possible in all future years. This assumption may seem unduly pessimistic but it makes for a rigorous stress test. If an income-protection strategy can weather a financial storm that severe, everything else will seem like child’s play. Now let’s consider three scenarios for how Nick and Sally deploy their nest egg.

Scenario 1

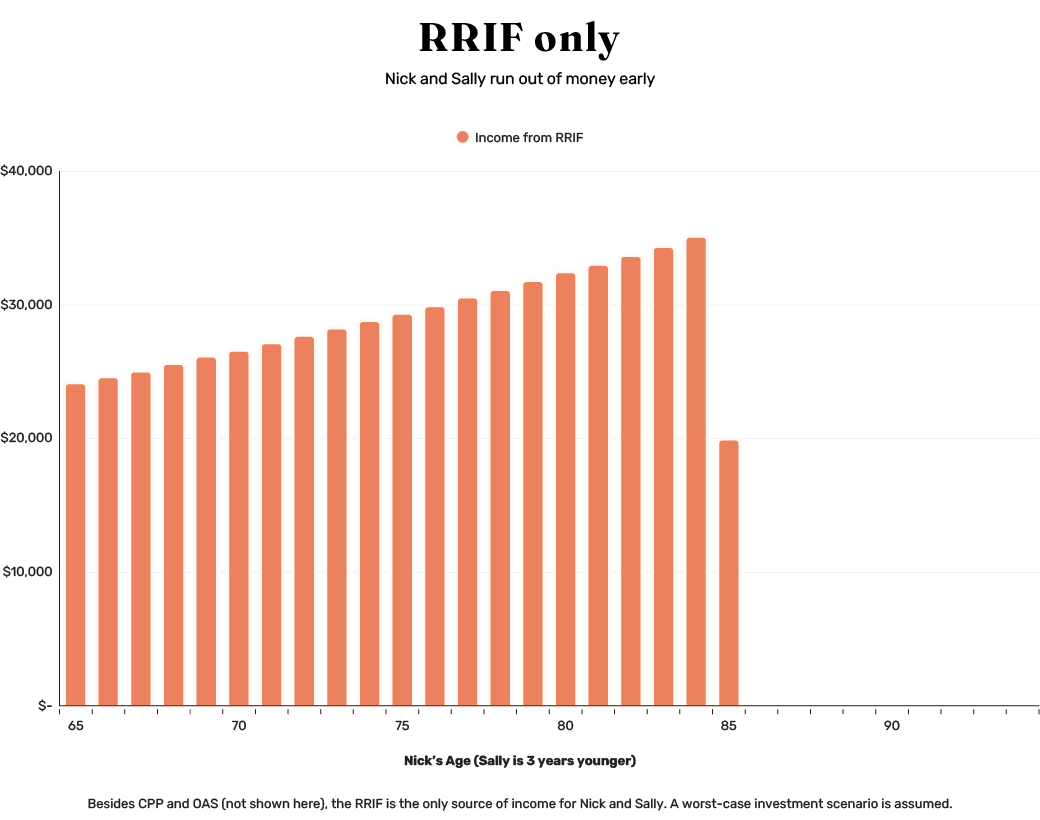

In the first scenario, Nick and Sally draw all of their income from their RRIFs based on the 4 percent rule assuming an investment in a typical balanced fund. As a result, their payout in year 1 will be $24,000 (4 percent of $600,000). This payout rises annually with inflation, which I assume will be 2.2 percent per annum. Because of the poor investment returns, their money runs out by the time Nick is just 85 and Sally is 82, leaving them only with government pensions (refer to Chart 1 below).

Scenario 2

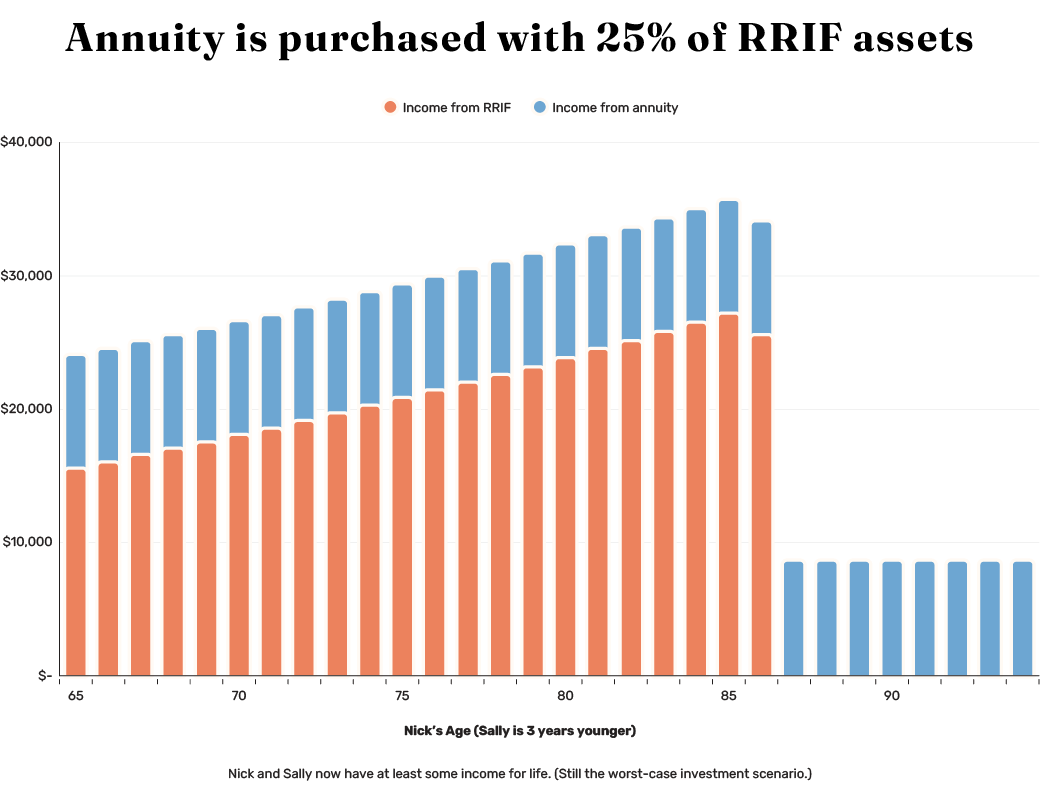

In Scenario 2, Nick and Sally use 25 percent of their RRIF assets to buy a life annuity at the point of retirement. According to Cannex, $150,000 would currently provide them with annuity income of about $8,700 a year. They would also receive a reduced payout from the $450,000 remaining in their RRIF so that the total income matches the $24,000 in the RRIF-only scenario. As shown in Chart 2, the annuity improves their situation. Until Nick is 85, their income is the same as before but now it lasts about a year longer and even when the RRIF does run out (at age 86), they will still have the $8,700 of annuity income for the rest of their lives. This is far from ideal but is much better than the RRIF-only scenario, and remember, they also get income from CPP and OAS.

Even though the annuity improves their situation, this second scenario helps to show why so few people buy annuities. First, no one likes the idea of irrevocably handing over a large sum to an insurance company – what if they die young? Then there is opportunity cost. The $150,000 would no longer be available to participate in market gains so the annuitant might feel like a chump getting just $8,700 in fixed income if the stock market ends up doing well.

Scenario 3

This brings us to the Purpose LPF scenario. Instead of an annuity, Nick and Sally invest in the LPF (I am assuming the Class F version with lower fees). For a 65-year-old investor, $150,000 invested in the LPF provides a starting income of $9,225 a year, with increases contemplated later in retirement as other participants in the LPF die (though, like most mutual funds, this is a targeted amount, rather than a guarantee. Income that Nick and Sally receive from the LPF may increase or decrease at any time).

Unlike an annuity, the level of payout from the LPF is not guaranteed if the stock market tanks. Under our 5th-percentile investment scenario, it would drop after year 1 to about $7,200, which is about $1,500 less than what the annuity would have paid. Payouts would remain at $7,200 until age 90 and then rise back up to $9,225. Between ages 66 and 90, the LPF result is worse than buying an annuity, but only slightly. Overall, the LPF in this scenario is marginally worse than the annuity option but significantly better than the RRIF-only approach.

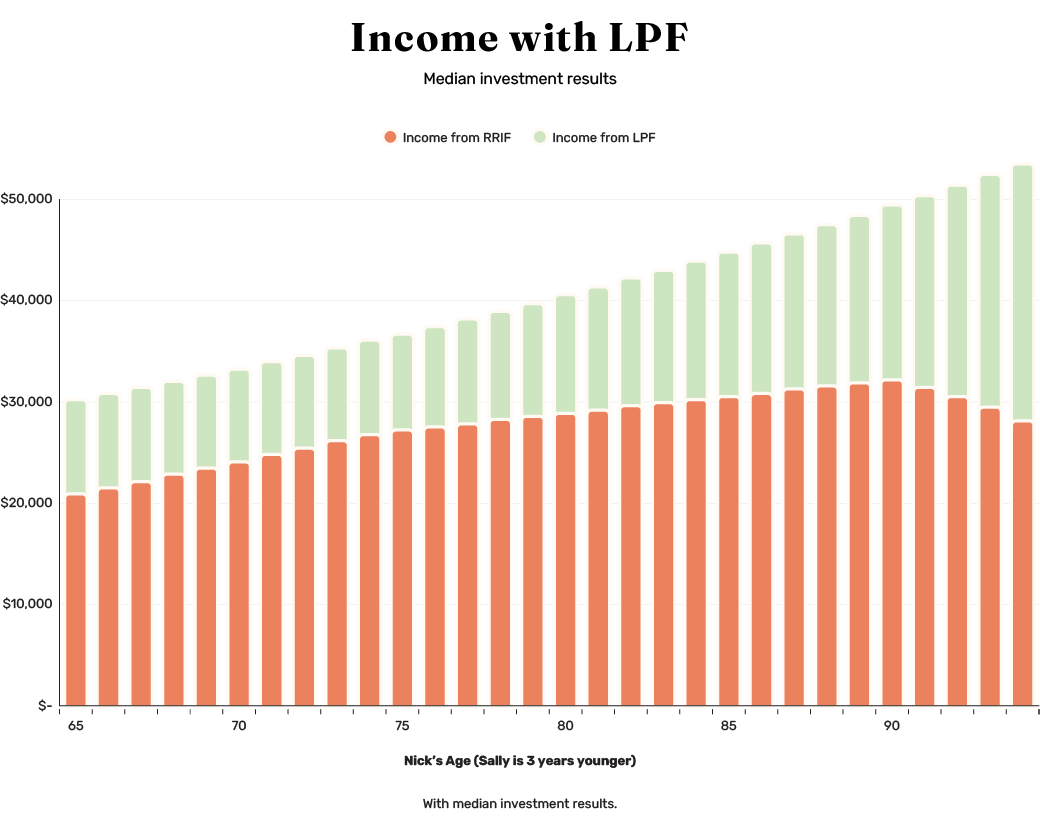

But the merits of the LPF become clear when we look at a mainstream investment scenario. If Nick and Sally achieve median returns in both their RRIF and the LPF rather than 5th-percentile returns, they can continue to receive their $24,000 a year in payments until they die at 94 (plus annual adjustments for inflation). They would also have over half a million dollars left over, which is significantly more than under either the annuity approach or the RRIF-only approach.

Alternatively, they could initially draw annual income of $30,000 from their RRIF and the LPF combined. This amount, plus inflationary increases, could continue unabated until age 94 and beyond, if Nick lives that long. This is shown in Chart 3. All they need is to achieve median investment returns.

Now here is the clincher – there is finally a good answer to the question, “what if I die young?” Even if Nick dies before receiving total payments of $150,000 (his initial investment) under the LPF, Sally would be able to redeem his investment to make up the difference between whatever Nick was paid out and his initial investment, or redeem at the current NAV of their investment (whichever is less).

In summary, putting a quarter of one’s RRIF into the Longevity Pension Fund provides almost as much protection as an annuity under adverse conditions and is significantly better than leaving it all in a typical balanced fund in a RRIF. But with median investment returns, the Longevity Pension Fund is significantly better than either the typical balanced fund RRIF-only option or the annuity option. We might finally be able to put the annuity puzzle to rest with the Longevity Pension Fund.

Frederick Vettese is former Chief Actuary of Morneau Shepell and author of "Retirement Income for Life". He is also a Consultant for Purpose Investments Inc. and a member of their retirement advisory committee. All views reflected here are his own.

This article is intended to be illustrative and should not be considered investment advice – the above scenarios are general examples, have not been tested as hypothetical performance data, and do not consider investors’ specific needs. For professional advice, speak to your advisor.

The Longevity Pension Fund is managed by Purpose. Commissions, trailing commissions, management fees and expenses all may be associated with the LPF. Always read the prospectus and talk to your advisor before investing. Investments in mutual funds are not guaranteed, and the LPF’s value may change frequently. Distribution levels and frequency may increase or decrease from time to time and are not guaranteed. Past performance may not be repeated.

This article contains forward-looking statements (“FLS”). FLS include anything other than historical information, including expected returns, the expected rate of inflation, etc. FLS depend on future events or conditions, are subject to risks and uncertainties, and are based on numerous assumptions. FLS are not guarantees of future performance - results could differ materially from those set forth in the FLS. The reader is cautioned to consider the FLS carefully, not to place undue reliance on the FLS. Purpose specifically disclaims any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.