Income for Life: How It’s Possible

Fraser Stark

.18 Jun 2021

.5 Min read

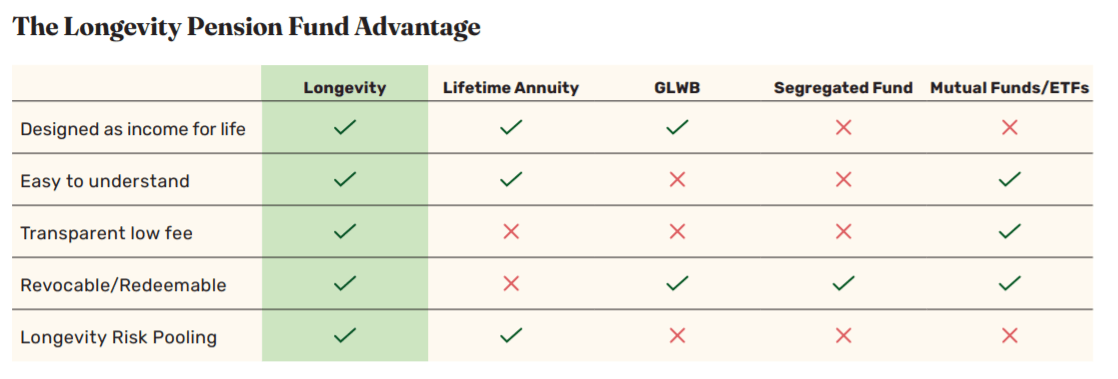

When we designed the Longevity Pension Fund, we wanted to find a solution to address the growing issue of income instability for Canadian retirees. To us, a simple solution to this problem involves providing income for life.

With an aging population and life expectancy increasing, we knew we had to provide Canadians with a practical solution. The Longevity Pension Fund’s income-for-life design, with starting distributions targeted at 6.15% for 65-year-olds, might seem too good to be true, but it is a testament to over three years of hard work, innovation, and collaboration with leading retirement and pension experts around the world.

So how did we do it?

1. Reverse Engineer a Pension Fund

To ultimately build the Longevity Pension Fund, we started by reverse engineering how pension funds and insurance companies provide long-term income. Why? There are lifetime income products out there, but some (e.g., defined-benefit pension plans) are not available to everyone and others (e.g., annuities) may not be widely used, either because they’re inflexible (typically the purchase of an annuity is a permanent decision where you no longer have access to your capital once the purchase is made) or because individuals feel like they’re betting against a large insurance company on their own life expectancy.

Consequently, we re-engineered how to deliver lifetime income inside a mutual fund structure so that all Canadians could have access to a defined-benefit pension-like plan where, unlike a typical insurance annuity, the investor can change their mind and redeem at any time.*

2. Assemble a Talented Team of Retirement Experts

Reverse engineering was not an easy feat. We participated in discussions with the Ontario Securities Commission regarding the fund design and answered questions about the innovation and novelty of the structure. Then, we built the actuarial models and structures similar to those at large pension funds.

Every step of the way, key decisions were debated by some of the top minds in the retirement space. We developed the fund in consultation with a group of industry leaders, including international pension expert, Keith Ambachtsheer of KPA Advisory Services Ltd.; Bonnie-Jeanne MacDonald, Director of Financial Security Research at Ryerson University’s National Institute on Ageing; as well as retirement finance author and former Chief Actuary of Morneau Shepell, Fred Vettese.

3. Provide Income for Life through Longevity Risk Pooling

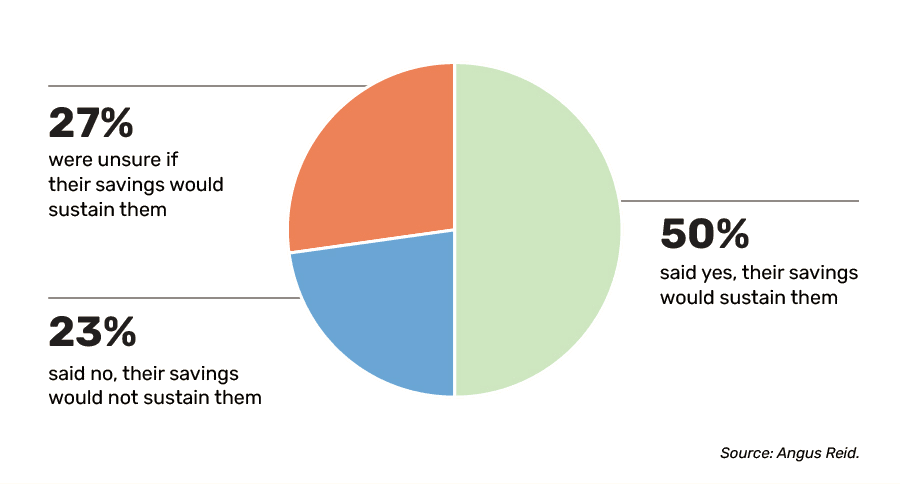

Half of Canadians aged 55+ do not believe their retirement savings will sustain them for the rest of their lives or are unsure if they will.

What makes the fund such a unique solution is that it incorporates the principles of longevity risk pooling into the structure of a mutual fund. To do this, we worked closely with our Custodian and Record Keeping partners to collect and provide the required investor data. Our models also incorporate actuarial assumptions that were reviewed and stress tested by Morneau Shepell.

This strategy was taken to close the retirement savings gap, so that Canadians would no longer have to worry if their income in retirement will last their entire life, however long it is.

Longevity Risk Pooling Explained

Longevity ‘risk pooling’ groups each investor’s individual risk of outliving their income together with other investors in a pool, thereby reducing collective risk. This is the same general concept underpinning pension plans and is cited as the optimal strategy for drawing down wealth in retirement by many retirement scholars.1

In order to appropriately pool longevity risk, the Longevity Pension Fund groups individual investors into cohorts of people roughly the same age—for example, people born from 1954-1956. While the fund’s assets are managed as a single portfolio, distribution rates are set for each cohort independently.

With this risk pooling structure, when an investor passes away and leaves the cohort, they are automatically redeemed at the lesser of either the remaining capital of their initial investment that has not yet been paid out via distributions, or the net asset value (NAV) of their initial investment (if NAV has decreased). The profits from the investor’s initial investment (which we call “longevity credits”) remain in the fund to be distributed to other members of the group as income from the fund income.

It’s this structural design that should enable distribution levels for remaining investors to be raised over time, as more longevity credits are added in the pool.** These longevity credits lower the net required return for the fund to roughly 3.75% to generate the lifetime income rates that we’re targeting.

Essentially, people are leaving the pool faster than dollars are, leaving more dollars per person remaining in the fund. For a sample case study detailing how this would play out, please read here.

Of course, distributions are not guaranteed and could increase or decrease. However, we are confident in this product design and believe we will sustain our target payout rates, as we’ve used conservative assumptions to establish the initial distribution levels.

At the end of the day, our mission with this fund is to give people the stability and confidence to make the most of their post-work years.

We are extremely happy with our solution and proud to be recommended by the Canadian Association of Retired Persons (C.A.R.P.), Canada’s largest advocacy association for older Canadians promoting equitable access to health care, financial security, and freedom from ageism.

If you have more questions about how this is possible, please take a look at our FAQ, and don’t hesitate to reach out to us at contact@retirewithlongevity.com.

1. Milevsky, Moshe Arye and Huaxiong, Huang, The Utility Value of Longevity Risk Pooling: Analytic Insights (March 10, 2018). Available at SSRN: https://ssrn.com/abstract=3138280 or http://dx.doi.org/10.2139/ssrn.3138280

Survey Methodology

An online survey of 1,503 Canadians was completed between May 18, 2021, and May 20, 2021, using Angus Reid’s online panel. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.4%, 19 times out of 20.

* The Fund has a unique mutual fund structure. Most mutual funds redeem at their associated Net Asset Value (NAV). In contrast, redemptions in the decumulation class of the Fund (whether voluntary or at death) will occur at the lesser of NAV or the initial investment amount less any distributions received. You can always access the lesser of unpaid capital (initial value of your investment less any income payments made) or your net asset value. Fees may apply. Please review the prospectus or speak to your advisor for more details.

**Although distributions are designed to increase over time, they may go up or down and are never guaranteed. The level will be assessed regularly, and impacted by market conditions and unitholder redemptions (both voluntary and due to death). For individuals 64 years and younger, investment returns are reinvested, and distributions begin in the month after turning 65 years old. The calculator assumes an annualized net return of 3.75%. The income payments shown are gross of taxes. Please review the prospectus or speak to your advisor for more details.

Forward-looking statements are not guaranteed

Certain statements on this page may be forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose believes to be reasonable assumptions, Purpose cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.