How Do You Solve a Problem like Decumulation?

Fraser Stark

.4 Nov 2021

.5 Minute Read

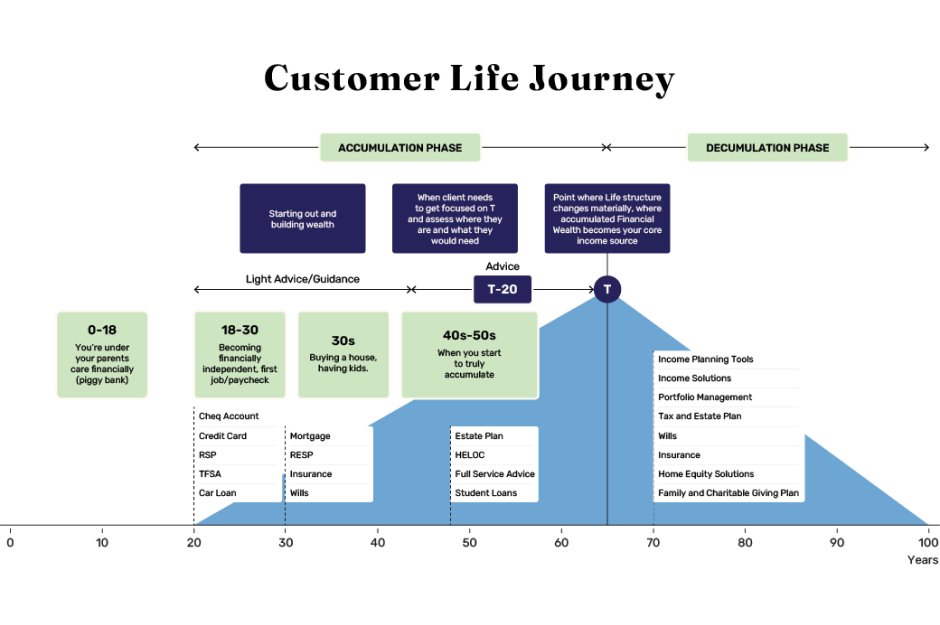

For most of our lives, we are focused on earning money and saving a portion of it, but that is only one side of the coin when it comes to retirement planning. In a world where people are living longer than ever, and the availability of defined benefit pension plans is shrinking, the problem of decumulation has shifted to the forefront.

Strategies and structures surrounding what a person should do after they retire exist, but none truly solve for decumulation in an investor-friendly way. Consequently, 50% of surveyed* Canadians aged 55+ are not confident that they will have enough money to last them in retirement.

What is decumulation?

Decumulation is the drawdown of savings to provide an income stream in retirement. Since retirees no longer earn a regular income, they instead rely on accumulated savings to finance their retirement lifestyle.

For many people, the decumulation phase also represents a shift in their investment strategies from ‘offense’ (increasing their salary and investing in high-growth funds) to ‘defence’ (saving their nest egg and making it last to ensure they have income for life).

Unfortunately, having a strong decumulation strategy is more complex than simply having a good defence. There are simply too many uncertainties involved, including the most important: uncertainty over how many years the money needs to last.

If you plan for too few years, you could find yourself at $0 with many years to go. If you plan to live for 117.63 years – the oldest a Canadian has ever lived – it’s very likely you’ll curtail your spending in ways that limit your dreams. Skydiving is expensive!

You may ask yourself: Will I outlive my savings? Do I have enough money to weather market downturns and unexpected life events? How long will I need my savings to last? Can I continue to be financially self-sufficient, or will I need to rely on family support? Will I be able to afford my lifestyle?

There have traditionally been few effective solutions to the problem of decumulation, leaving retirees to fend for themselves to achieve long-term financial security. This is one of the contributing factors of the retirement savings gaps around the world.

What is a retirement savings gap?

A retirement savings gap is the difference between the amount of money someone has saved and how much they will need throughout their life.

As illustrated above, the average Canadian risks running out of money about a decade before they die. The problem is even worse for women, who on average live longer. But this problem can’t be blamed on any one individual.

The problem of decumulation is a systemic, structural issue surrounding retirement planning options offered around the world. Studies state that the size of the world’s collective retirement savings gap could exceed US$400 trillion by 2050.1 Yes, that’s trillion with a “T.”

Solving the problem of decumulation

The Longevity Pension Fund helps solve the problem of decumulation with a retirement solution designed to provide Canadians with income for life.* The Longevity Pension Fund democratizes retirement by offering a defined-benefit-plan-type solution through a mutual fund structure so that all Canadians can access a retirement lifetime income stream.

By incorporating the concept of longevity risk pooling, the Longevity Pension Fund helps close the retirement savings gap by grouping people's individual risks of outliving their savings.

Each person gives up some investment returns if they don’t live as long, in exchange for the assurance of income for life if they have a long retirement. But given the uncertainties of life, the Longevity Pension Fund also ensures people always have access to the lesser of their NAV or their unpaid capital – their initial investment less the payments received.** This allows retirees to access their money for unexpected needs during retirement, or leave something to their estate if they pass away early.

There are other solutions to help with decumulation, like buying annuities, deferring government pension programs, accessing home equity, and so on. For those looking for a detailed overview on this topic, Fred Vettese’s book Retirement Income for Life is a great starting point. A financial planner or advisor can help you understand your retirement income needs, and how the Longevity Pension Fund and other tools can help you attain it.

Interested in learning more? Talk to your advisor or contact us today.

1. “Retirees risk running out of money a decade before death,” BNN Bloomberg, June 2019: https://www.bnnbloomberg.ca/retirees-risk-running-out-of-money-a-decade-before-death-1.1272545

*Survey Methodology

An online survey of 1,503 Canadians was completed between May 18, 2021 and May 20, 2021, using Angus Reid’s online panel. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.4%, 19 times out of 20

* Income distributions and returns for the Fund may fluctuate and are never guaranteed.