Retirement Through the Ages: A History of Pensions and Policies

Simon Barcelon

.26 Oct 2021

.5 Min Read

The concept of retirement wasn’t initially created to reward people after a lifetime of hard work. In fact, it had a much more strategic—maybe even Machiavellian—origin story. Basically, retirement and pensions were used as political tools to reduce civil unrest, decrease youth unemployment, and maximize productivity.¹

Over time, medical and industrial advancements allowed people to actually embrace retirement. As we collectively started living past the age retirement benefits kicked in, the idea that there was more to life than work sunk in. Golf courses and retirement homes started popping up in Florida, and the idea of “Freedom [at] 55” became a common motivator for those in the workforce. Now, as life expectancies grow while defined-benefit plans dwindle, retirement is undergoing yet another transformation—one that calls for a solution.

The Invention of Retirement

“The question isn’t at what age I want to retire, it’s at what income.” – George Foreman

Many consider retirement to be a hallmark of the modern age, but its invention can be traced back to 13 B.C. when Emperor Augustus instituted a pension program for Roman legionnaires who served 20 years in the military.¹

Although Augustus wasn’t motivated by quality-of-life concerns for his legionnaires—this program was enacted as a way to prevent an uprising against the Roman empire—Augustus’ program marks the first recorded practice of people retiring and receiving retirement benefits.

Why People Retire at 65

“I never had the sense that there was an end: that there was a retirement or that there was a jackpot.” – Leonard Cohen

Since then, the concept of retirement and pension programs went through several evolutions through the years. An important milestone happened in 1889 when German Chancellor Otto von Bismarck decided to pay citizens 70 and older to leave the workforce voluntarily to address youth unemployment.

The age was later revised to 65, and many say this is the precedent of retirement age as 65. However, the average global lifespan at that time was only 42.5,² showing that the societal expectation was that most people would work their whole lives.

When Retirement Became Synonymous with Golf, Florida, and Leisure

“My parents didn’t want to move to Florida, but they turned sixty and that’s the law.” – Jerry Seinfeld

The 20th century saw huge advancements in technology and medicine, massive population growth, and a shift from an agrarian to industrial economy. Below are just a handful of high-level reference points of all that went down between 1910 and 1950.

1910: Florida became known as a retirement destination for the middle-class.

1920: 84% of railroad workers were covered by a defined-benefit plan in the United States,¹ retirement communities started being developed, and the number of golf courses in the United States tripled.³

1928: Alexander Fleming discovered penicillin, the world’s first antibiotic, which proved to be an essential medical advancement for improving longevity.

1935: Franklin Roosevelt’s Social Security Act established retirement benefits at the federal level in the United States for 65-year-olds.

1947: About one in five employees in Canada had a registered pension plan at their job.⁴

1950: Average life expectancy in Canada was 67 years old.⁵

1952: Canada introduced Old Age Security for people 70 years old and over.

1965: The Canada Pension Plan legislation was passed and the qualifying age for OAS was reduced to 65 from 70.

1966: The Canadian Pension Plan and the Quebec Pension Plan came into effect.

In Canada, by 1950, life expectancy was higher than retirement age, meaning that for the first time the average person could actually live out their post-work years and take up hobbies, tend to the garden, sip beer on the bay, etc. Retirement meant time was yours.

Another interesting development from the list above is that, following the Industrial Revolution and the two world wars, golf courses started to be developed in droves, and the onset of radio, film and television meant that people had convenient, enjoyable ways to pass the time. Yes, the concept of “leisure time” was born. Life for the average Canadian was less of a Dickens novel, and the preconception that you would spend your whole life working was reconceived.

Retirement Today

“Retirement is like a long vacation in Las Vegas. The goal is to enjoy it to the fullest, but not so fully that you run out of money.” – Jonathan Clements

It’s not a profound statement to say that life as we know it today looks a lot different than it did when Canada introduced Old Age Security (OAS) in 1952 or the Canada Pension Plan/Quebec Pension Plan in 1966. Yet, advancements to retirement policies, programs, and products have not had the same growth trajectory. In fact, you could argue that, if anything, the industry has gone backwards when it comes to providing practical retirement solutions to Canadians.

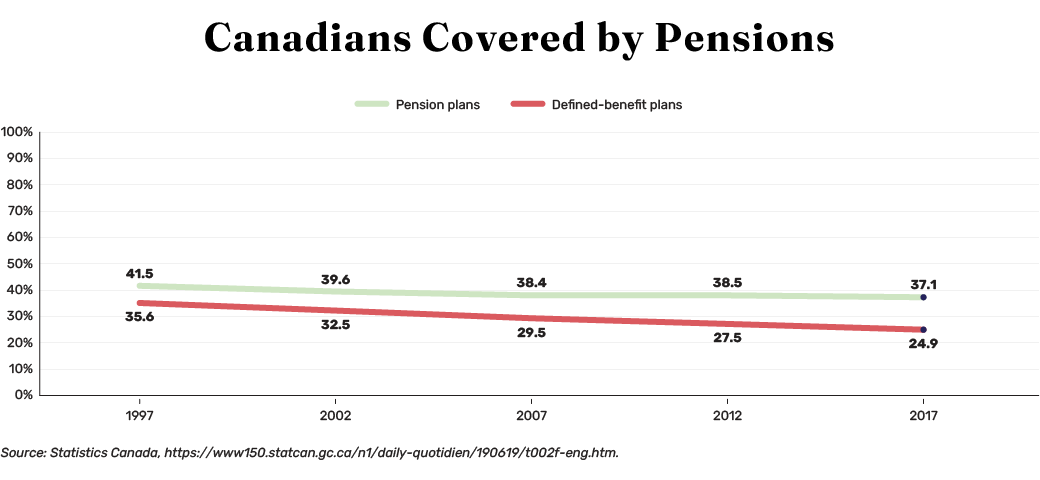

According to Statistics Canada, Canadian workers covered by pensions and defined-benefit plans have been steadily drifting downward over the past two decades. Meanwhile, life expectancy continues to increase, and in Canada, there is a 40% chance that one member of a couple will live until they are 90 years old.

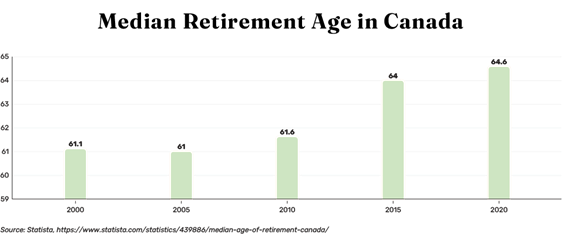

For many, our increasing lifespan has complicated retirement planning. A common fear people have is whether they’ll have enough savings to last them, which can result in people delaying retirement or living more frugally than necessary.

Retirement shouldn’t be something we postpone or engage in half-heartedly because we worry we will live too long. You should be able to enjoy it to the fullest without fearing you will run out of money. Likewise, financial planning in retirement doesn’t need to be overwhelmingly daunting or complex.

With Longevity, we aim to solve the “problem” of our increasing lifespan with a mutual fund that confronts it head on by pooling longevity risk in a similar way a pension does. We’re hopeful with this innovation, we are able to once again redefine retirement so it can be seen as an opportunity, not a challenge.

Please reach out if you’d like to learn more about the Longevity Pension Fund. Your investment advisor can help determine if this investment product is suitable for you.

“The History of Retirement,” The Fiduciary Group: https://www.tfginvest.com/the-history-of-retirement/

“Life Expectancy by Age,” Info please: https://www.infoplease.com/us/health-statistics/life-expectancy-age-1850-2011

“America in the 1920s,” Michael J. O'Neal, page 28: https://books.google.ca/books/about/America_in_The_1920s.html?id=jUX6ByHyDwUC&redir_esc=y

“Pensions: The ups and downs of pension coverage in Canada,” Statistics Canada, https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2015003-eng.htm

“Life expectancy, 1920–1922 to 2009–2011,” Statistics Canada, https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016002-eng.htm

The content of this document is for informational purposes only, and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained on this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice and neither Purpose Investments Inc. nor is affiliates will be held liable for inaccuracies in the information presented.